Some Twitter friends/followers are asking my view after an excellent Q3 result by TechNVision. Here are my views.

Question about sustainability and buying at this level.

TechNVision has a history of bad Q4, let’s wait till that time.But, no harm in adding few .

Question about write off

Yes , they did write off in 2019 . Generally, write off are bad but many product-based software companies have to write off, the main reason that all products don’t get successful, like our portfolio there are some failed products. The company was carrying product development cost in the gross block and it was of the period before 2010. Ideally, they should have gradually deprecated it over the period from starting 2005 or put that in expenses. But, in 2019, they have written off the legacy product which is no longer useful or revenue-generating since they entered in the cloud. So, they have written off.

Now, they put product development cost in P&L as expenses instead of the gross block in the balance sheet. If they have put it in the balance sheet then we could have seen more than 30 crores in profit.

It is debatable where to put product development cost which going to generate a return in future for many years. Most of the conservative companies put in P&L. Some may choose to capitalize software product development costs in balance sheet and show great profit numbers.

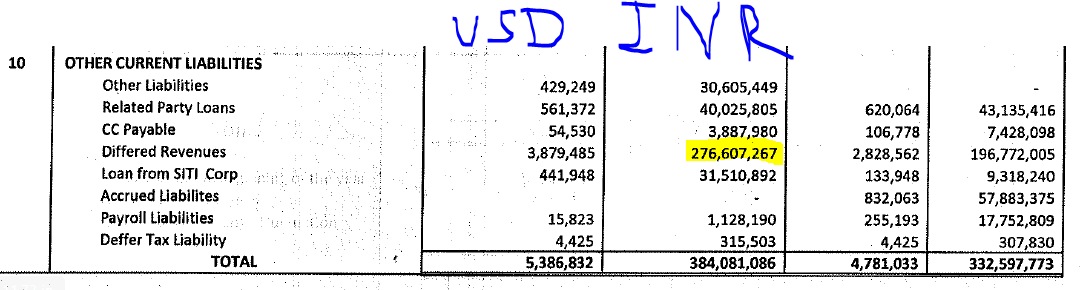

Question about Current Liabilities.

Yes, Current Liabilities are mainly advances from the customers (Differed Revenue), in fact, any company with high advances from the customers has a moat.

If you want to see it in detail then one can see subsidiary Solix Technologies USA audited report at https://t.co/wIrd8Vxv3g?amp=1 which I had requested from C.S.

Question about Products

TechNVision has two step down subsidiaries in USA Solix and Emagia .

Solix :

Solix has two main products, first https://cloud.solix.com/ (Solix Cloud) and secondly they have just developed another product https://cloud.solix.com/enterprise-content-services/ (Solix Cloud ECS)

Solix Cloud is all about Big Data , AI , Legacy Application Retirement, and Archiving.

However new product Solix Cloud ECS is like DropBox and shareit. We mainly use dropbox for sharing but it also has DropBox Advanced (Enterprise Edition). Solix ECS is going to compete with DropBox Advanced for enterprises ( not for people like us)

Solix is having the lowest cost in Enterprise cloud sharing. Please invest your some time in this big article https://www.linkedin.com/pulse/disrupting-saas-pricing-content-services-charlie-garry/ or read the last few paragraphs to understand better.If you just need backup then digiboxx offers the lowest rate in India but it doesn’t have Enterprise Edition .

They have created Solix ECS at low cost but it will require some marketing expenses. It will give fruits in the long run but if they spend on marketing then it will impact profit for next few quarters.If Solix sells Solix Cloud ECS product to big companies like TCS, HCL, Cognizant , Accenture, then these biggies will extract hundreds of crores from this product because they can sell to existing thousands of customers and also have a strong marketing team.It makes sense to sell this product to some biggie instead of spending huge marketing expenses or do the partnership with them as they are doing for archiving / Legacy Application Retirement.

Emagia : (https://www.emagia.com/products/emagia-cloud/)

Implementation of Emagia for Unisys corporation is telling that product is very promising. A SaaS solution is deployed at Unisys shared services for managing global accounts receivables in more than 90 countries, operating in 7 different languages, connected to over 170 banks for driving world-class operations efficiency.

There are very few products in the world that can support in 90 countries and 170 banks, there are going to be different regulations and rules, etc and many challenges.

Put yourself in the shoes of an MNC global CEO/CFO who has operations in many countries and he or his team can see consolidated global one view of cash flow/receivable real-time or daily.

Every global CEO/CFO will love this type of SaaS cloud product.

As per my understanding, even one of the biggest SaaS cloud products like oracle HCM cloud might not have support for 90 countries.

Emagia getting recognition in the industry, you can sense from joint Webinar with Cognizant. https://www.youtube.com/watch?v=qNTg3Wpozas

You will surprise to know biggie Cognizant has won a prestigious award for digital transformation due to Emagia solution.

You can read my previous article on TechnVision at

http://value2wealth.blogspot.com/2020/11/snowflake-inc-vs-technvision-can.html

No comments:

Post a Comment