I have asked the fowling question for the contest .

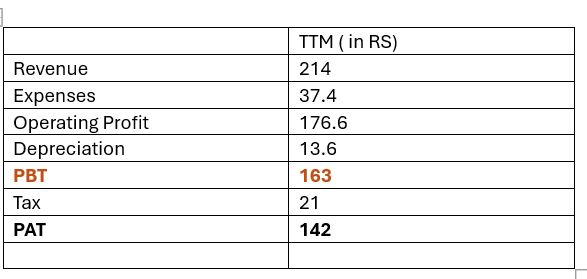

If one want to understand IT product company then must understand "Product Capitalization" policy. It helps to understand real profit vs accounting profit.

Product company Aurum PropTech has changed "Product Capitalization" policy from FY24.

If TechnVision had made same changes in "Product Capitalization" policy in FY24 what will be their profit ? Aurum PropTech has started capitalizing its product development expenditure in balance sheet as Intangible assets.

|

Lets assume TechnVision is spending 70% in product development which will bring revenue for more than 1 year , 20% expenses responsible for current year revenue and 10% for mandatory product capex like changes due to regulatory changes. If you do VC style investing then you have to calculate adjusted PBT and give valuation .What could be PBT of TechnVision in last TTM ?

Assignment : Lets look into screen shot and complete the assignment ?

Two Winners will get 100 Baggers book hard copy .

Hint : One item which is present on both P&L and balance sheet will also change . You may assume it 10% or plus as per your comfort.

|

Answer of TechNVision adjusted PBT contest .

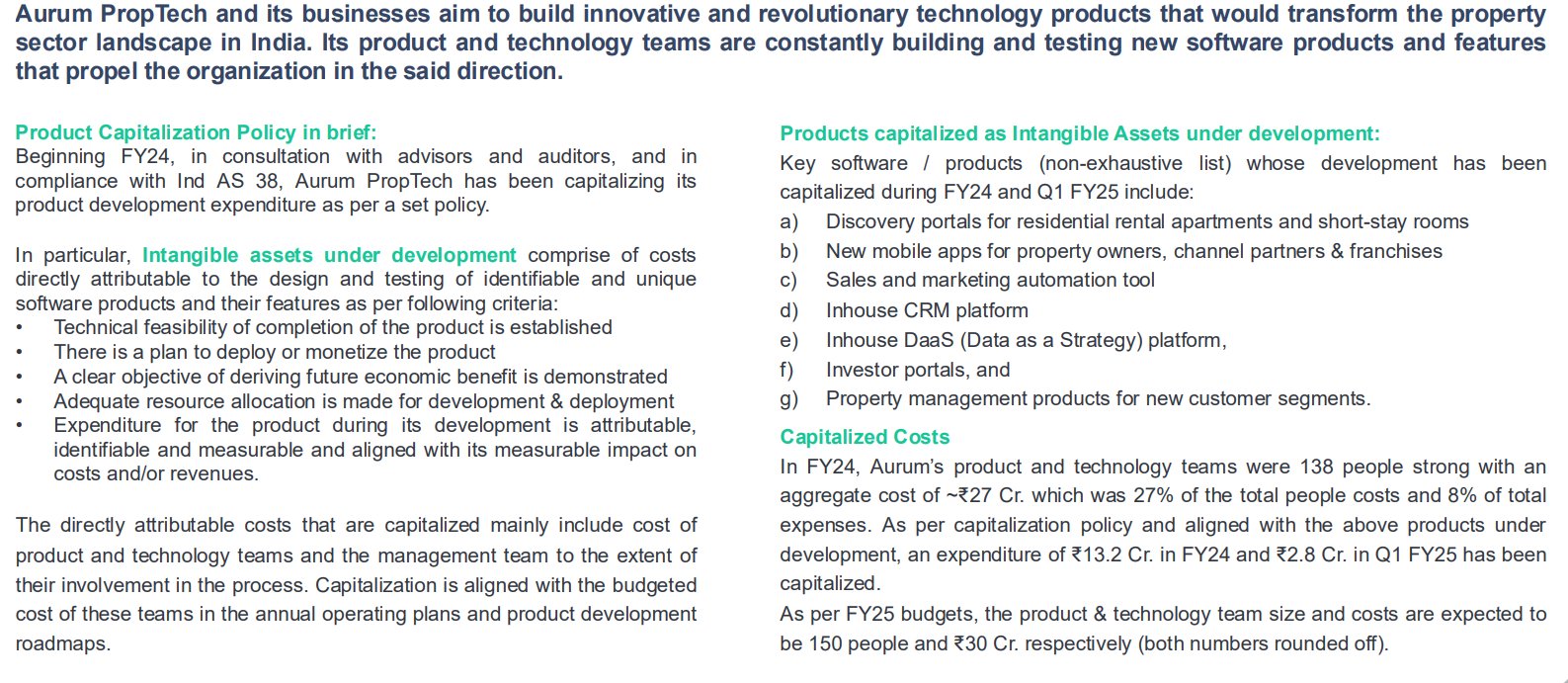

Reported Total Expenses = 187 Cr.

Before adjusting expenses , let’s understand difference between Asset and Expenses in accounting .

Expenses : An expense is a resource that the business has already consumed during the operations of the company for a specific accounting period (Financial Year).

Asset : An asset is a business resource that offers economic benefit to the business in the future beyond current period (Financial Year)

Now ask question to yourself is company putting all product development cost for generating revenue of this year ? Will this product will be in use next year ? Based on our answers do assumptions,

I assumed TechnVision is spending 70% in product development which will bring revenue for more than 1 year , 20% expenses responsible for current year revenue and 10% for mandatory product capex like changes due to regulatory changes etc.

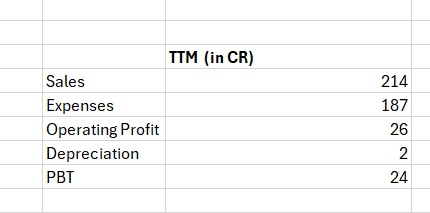

Clearly , 70% of 187 cr spent on product development is Asset (130.90 cr ) while 20% (37.4 cr ) spent on current year implementation is expenses .

10% for mandatory product capex is nothing but depreciation or amortization . But , depreciation will be on accumulate assets ( 10% of (130.9 asset + previous asset 5cr) = 13.6 ) not just on current year.

Depreciation/amortization will be part of both balance sheet as well P&L .

I don’t know US exact tax rate but may come around 21% based on US tax rate for IT companies.

Let’s assume 63 cr adjust for previous yeas losses still it can have 100 cr taxable income . Assume tax of 21 cr.

Now our P&L will look like in screen shot. Please refer it.

|

Received the following 6 entries .

@manoj_aggi 165 Cr

@RaisingSun69 142.81 cr

@patel_vsh 108.66 cr

@kys221_account 142 cr

@bujjitweet 82 cr

@Harjap1313 50-53 Cr

Contest was on PBT , correct answer as per my calculation is 163 crores .

@manoj_aggi answer of 165 Cr is closest . He is first winner.

Second best answer was 142.81 cr from @RaisingSun69 .

Third best was 142 cr from @kys221_account

.

There was not much difference between him and

@RaisingSun69 So , All three deserves gift . Congratulations to all 3 winners .

It doesn’t mean any buy or sell recommendation . It just means if someone says a product company is expensive then you just calculate adjusted PE .If any VC or competitor want to buy, they will do similar type of exercise with lot of other parameters.

No comments:

Post a Comment