You might have heard SaaS companies are trading at high sales multiple in the USA or I have mentioned Snowflake is trading more than 170 times sales in a previous article .

http://value2wealth.blogspot.com/2020/11/snowflake-inc-vs-technvision-can.html

Source : @jeevanpatwa Twitter for the Image

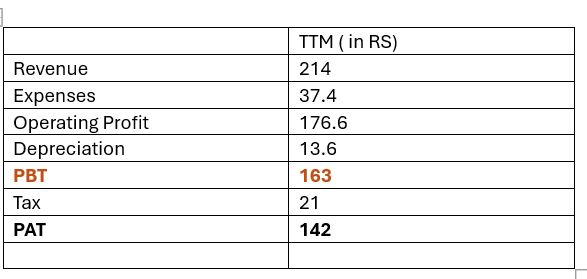

US-based investors give SaaS Product companies valuation based on SDE (Seller Discretionary Earnings) or EBITDA or Revenue.

There are very limited SaaS Players in the Indian stock market ( I am betting on TechNVision) but Indian stock investors are conservative in their approach and will not give a valuation based on sales.Similar stuff was playing in pharma or API. Investors love to give a valuation based on P&L mainly PE. Sajal Kapoor sir ( @unseenvalue ) has seen something that PE-based guys were not able to see a few years back. Once, EPS improved everyone can see. Now everyone is seeing EPS and growth, valuation improved and stocks become 3-4 times in a quick period.

A recent tweet from Sajal

He is an expert in pharma/chemical but I am not an expert in SaaS/Cloud even though I am working in a software product company. I am trying my level best to understand it. If you are interested in SaaS/Cloud or software product companies then you will have to learn about it.

I am trying a simplified valuation model for Indian Investors who can give PE based valuation to software product companies even loss-making.

What a crap? how can we value the loss-making companies on PE loved by an Indian investor?

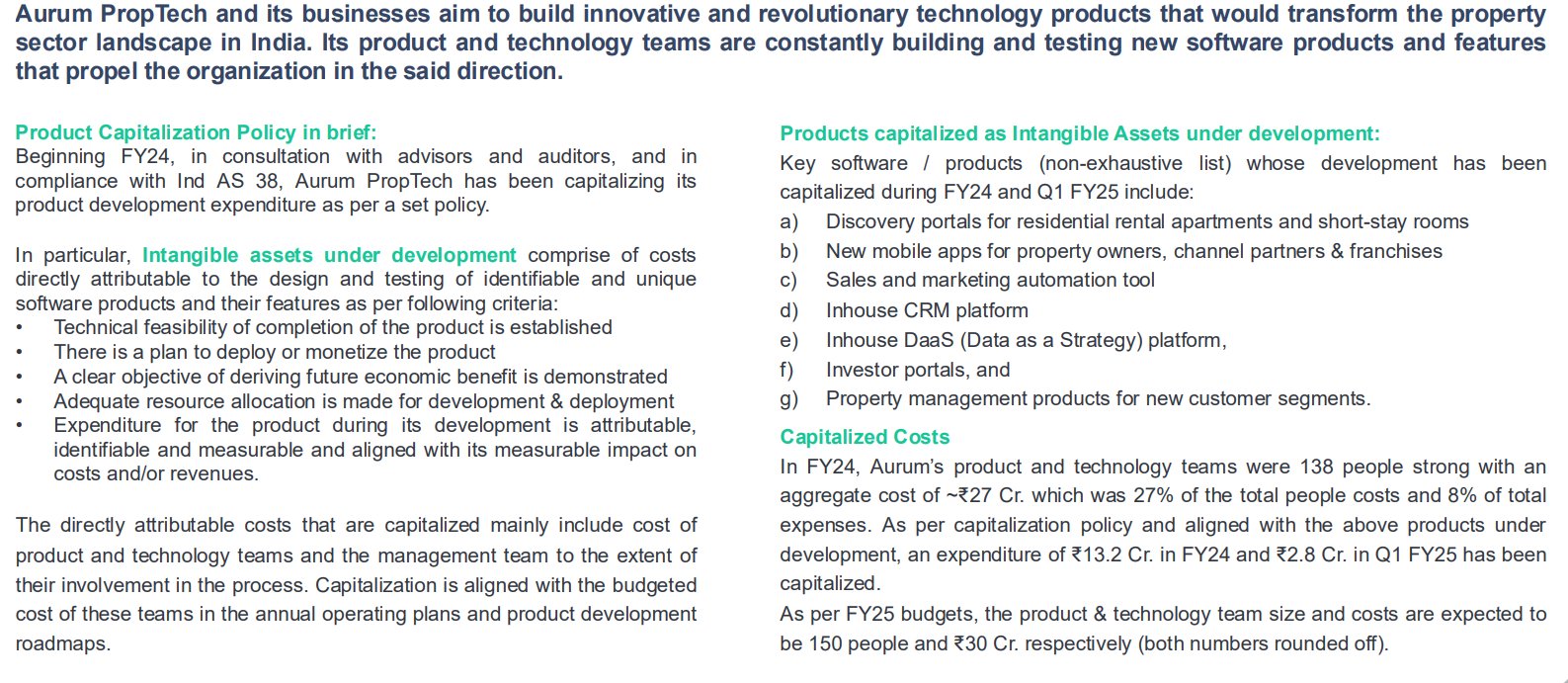

Wait, read till the end, you may give PE valuation to a loss-making company. Let's consider this company A .

If I ask you to value this company based on PE then you may say how can we give multiple to -5 crores PBT. But, you can get data to give multiple based on PE from my simplified method.

For this, you will need some basic accounting knowledge, I am also not an expert but have gained some basic knowledge over the years. Romancing the Balance Sheet is a very good book for beginners, https://www.amazon.in/Romancing-Balance-Sheet-Manages-Business/dp/9350294311/ref=sr_1_1?crid=1OTTUEX6MOTZ2&dchild=1&keywords=romancing+the+balance+sheet+by+anil+lamba&qid=1613274578&sprefix=romancing+%2Caps%2C267&sr=8-1

There are two sections in accounting P&L and balance sheet.

A wrong entry such as Inventory in the balance sheet can impact P&L, some companies used that trick to manipulate P&L. Leave it that is not our topic for today.

We already know expenses go to P&L and asset goes to balance sheet. Every expense should satisfy the test of consumption. E.g. 20 cr raw material used to get topline of 100 cr then 20 cr raw material will be expenses, next year if company again makes 100 cr, it will have to use another 20 cr raw material. If the company brought 100 cr machine, will it go as whole 100 crore expenses the first year if that machine is going to use for 10 years? If all 100 crores go to expenses in P&L then the company will show losses in P&L. 100 crores spent on the machine which can produce revenue for 10 years will go to the balance sheet as 100 crores asset. P&L will only have depreciation (around 10%) . Now, P&L can show a profit of course depends on other expenses.

Mostly if a company spends on capex and the gestation period is long then P&L will be impacted by depreciation and initial expenses that provide an opportunity to deep drivers like Sajal Sir. Everyone can’t see it. Professor Sanjay Bakshi sir and some other investors identified the similar type of discrepancies in Relexo and other companies which spend on branding. Advertisement cost doesn’t fully satisfy the test of consumption but it is still treated as expenses in P&L which causes depressed profit figure for the current year.

Now, come back to our example product based company A. It has spent 100 crores on employees salary. If they are doing product development that can be used for let's say 10 years then does this expense satisfy the test of consumption.

No, then it is not an expense but it should be an asset under Balance Sheet. But, as per current conservative optional accounting norms they have put in expenses which causing 5 cores loss. Should we put 100 crores under the balance sheet as an asset?

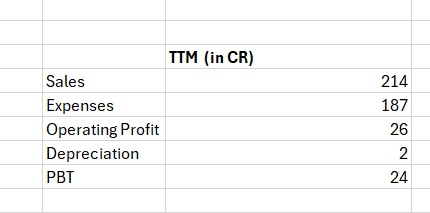

Not entirely, most of the product companies have two buckets in timesheet entry. Billable and non-billable development. Billable development works to satisfy the test of consumption because you are doing some specific work for some customer which may be used for others or may not. Most product companies put even this billable work in product with some flag/switch If this feature can be re-used by other customers, it enhances the product features. It is debatable if Billable development works as an expense or asset. For simplicity, assume it satisfy the test of consumption, so it is an expense. Let assume Non-Billable and Billable development works in the ratio of 70:30 . Non-Billable product development works don’t satisfy the test of consumption then it should go to the asset under the balance sheet. Now new P&L will look like …

New PBT is now 65 crores. Can Indian conservative investors give PE based on PBT ? Yes. One can give 5, another 10, some 20 or some even 50. If someone gives PE of 25 to PBT then the valuation of stock will come around 65*25 = 1450.

Almost 10 times to sales.

Please note Solix Technologies USA and Emgia Corp USA combine spends 95.24 as Employee Cost out of total revenue of 125 cores and posted PBT loss of 2.44 crores last year. Please also note, corrected annual report of TechNVision shows fewer figures due to their stake of around 67-70% and reducing inter-cross revenue between them. I am going to request the company secretary of TechNVision to put audited reports of subsidiaries on their website. So, we can get a clear picture. If you are an investor then please you also request to him.

I don’t want to go deep into TechNVision for this article now let's decide PE for company A.

While deciding PE for SaaS product companies, you will have to check some factors.

- Is it cyclic? then give PE of 5-10 , of course not

- What is the addressable market size?

- Growth & expected dilution of equity

- Subsidiaries structure

- Competition

- Recognition of product in Industry

- Product Maintenance & competition features cost

- Revenue Model ( Upfront or recurring)

- Promoter stake and their skill set

- Location of the addressable market

- Peer Valuations

- How strategic fit this company for acquisitions by a big company.

- and many more ...

Most of the SaaS cloud players get higher valuation because of their recurring revenue model. Initial revenue is low but it came at a regular interval ( like renting flat vs selling an entire flat). Both can't have the same PE ratio.

Now, come back again to product company A . P&L submitted to exchanges will show a loss, It will trade less than 100 crores with prices to sale ratio of around 0.67. Around 99.9% of investors will feel this loss-making company doesn’t even deserve 100 cores valuation. As per exchanges, it is making losses they will put in GSM/ASM category. Most of the brokerage houses will not allow trading in this counter.

Now management decided the product is features rich and doesn’t want to develop new features or develop an entirely new product for 1-2 years. They will cut non-billable development by 80% and do compliance changes, the competition features to survive in just 20% of non-billable bucket. No company can fire 80% of the employee for few years then take back again. Most of the product companies either invest in the same product for new features or create a new product. Some kind of virtuous cycle. Amazon did the same thing that's why investors who bought initially based on free cash flow instead of PE got multibagger returns. But, let’s assume for simplicity they will cut non-billable costs by 80%.

Next year they also grow by 30% then P&L with the old model and new model will be the following.

Now, PBT is around 100 crores with new model and even PAT will be around 100 crores since the company had carried losses from so many years, the tax will not be applicable. Now, even a 1000 crores market cap will look less against the earlier 100 crores within 1 year for the same set of investors.

Happy Investing ……………

Disclaimer : Please treat this post as starting point of your research and not conclusion to invest in any discussed stock. As always , please take the advice of a SEBI qualified financial adviser which I am not .